A Message from our President and CEO, Don Wilkinson

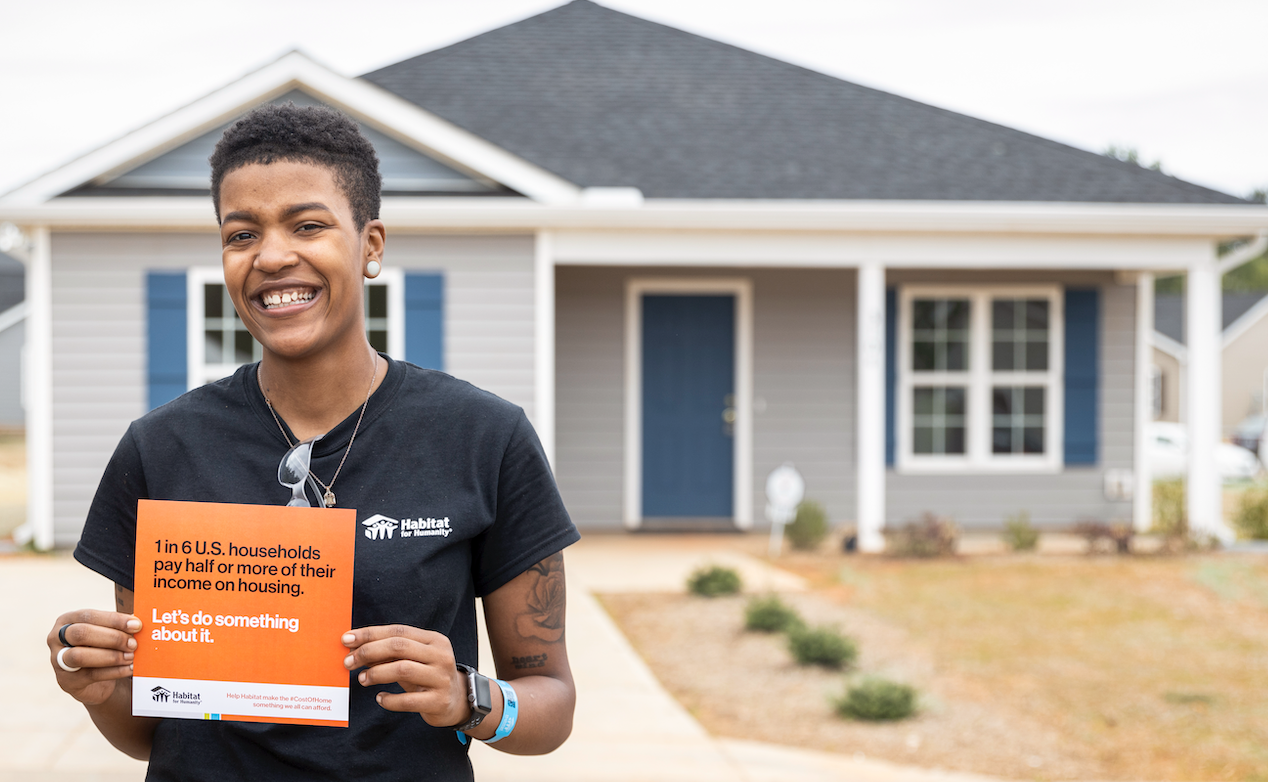

Among the abundance of challenges families face, the choice between a stable home and meeting essential needs shouldn’t be one. At Habitat for Humanity of Michigan, we’re steadfast in our belief that every family deserves the security and dignity of a safe, affordable home. It’s a fundamental right that should never be compromised by the cost of living. Yet, in Michigan, far too many are forced to navigate this impossible trade-off between housing expenses and critical necessities like food, medication, and education.

Affordable housing isn’t just about shelter; it’s the cornerstone upon which stable, thriving communities are built. It’s about fostering a foundation where families can grow, children can learn, and dreams can flourish. No one should have to sacrifice basic needs to secure a roof overhead. That’s why our work at Habitat for Humanity of Michigan isn’t just about constructing houses; it’s about crafting hope, resilience, and opportunity for every individual and family in need.

Together, let’s stand united in our commitment to ensuring that affordable housing isn’t a distant dream but a tangible reality for every Michigander. Let’s advocate, build, and empower, knowing that by providing affordable housing, we’re not just changing lives—we’re building a brighter future for our entire community.

Warm regards,

Don Wilkinson

Habitat for Humanity of Michigan